Navigating Water Damage Insurance Claims in Louisiana: Your Step-by-Step Guide

A comprehensive guide on navigating insurance claims for water damage in Louisiana, including understanding different types of claims, the importance of thorough documentation, strategies for interacting with insurance adjusters, and accessing legal support and resources.

Water Damage Insurance Claims in Louisiana

Navigating insurance claims for water damage in Louisiana presents unique challenges for homeowners due to the state's susceptibility to hurricanes, storms, and flooding. Louisiana's geographic location and weather patterns make water damage a prevalent issue that residents must address promptly to prevent further property damage. For example, heavy rainfall during hurricane season can lead to roof leaks, foundation flooding, and extensive water damage within homes. It is essential for homeowners to take immediate action when faced with water damage to mitigate potential health risks and prevent mold growth and structural deterioration.

In Louisiana, weather-related incidents such as hurricanes, severe storms, and flash floods are common triggers for water damage claims. These extreme weather events can cause significant property damage, emphasizing the importance of being prepared and proactive in handling insurance claims. For instance, homeowners may experience water intrusion due to storm-related roof damage, resulting in interior water damage that requires immediate attention. By promptly addressing such issues and documenting the damage accurately, homeowners can enhance their chances of receiving fair compensation from insurance providers.

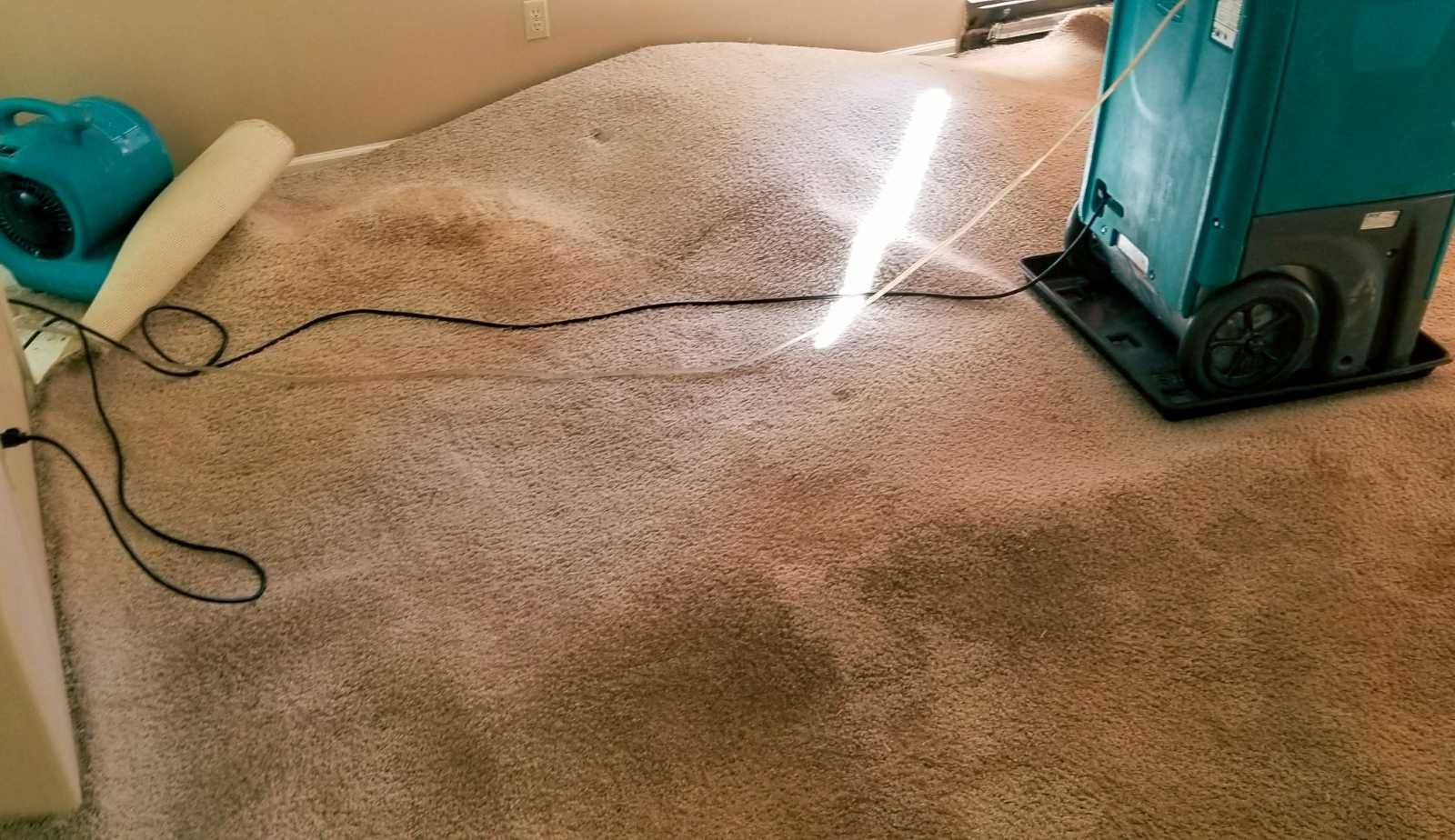

Drymax's specialization in water damage restoration services. For instance, if a homeowner experiences water damage due to a burst pipe, Drymax's expertise in assessing and restoring such damages can expedite the claims process. By collaborating with a reputable restoration company like Drymax Mold, homeowners can navigate the complexities of insurance claims more efficiently and ensure thorough restoration of their properties. Drymax's prompt response and professional services further highlight the importance of choosing a trusted partner in the restoration process.

Understanding Different Types of Water Damage Claims

When dealing with water damage claims, homeowners must differentiate between sudden and accidental damage versus gradual damage to understand how insurance policies may cover these scenarios. For example, sudden and accidental water damage may result from a pipe burst, while gradual damage could stem from a long-term plumbing issue. This distinction is crucial as insurance policies often treat these types of damage differently, impacting coverage and claim outcomes.

In Louisiana, water damage claims can arise from various sources, including plumbing issues, roof leaks, and adverse weather conditions. For instance, a sudden storm causing flooding in a home can lead to extensive water damage that requires immediate attention. Understanding the causes and types of water damage can help homeowners prepare for potential incidents and ensure they have the appropriate insurance coverage in place. By recognizing the specific risks associated with water damage in Louisiana, homeowners can tailor their insurance policies to better protect their properties.

The coverage differences for various types of water damage in insurance policies highlight the need for homeowners to review their policies carefully. While sudden and accidental damage may be covered under standard homeowners' insurance, gradual damage may not be included without specific endorsements. For instance, if a homeowner experiences water damage from a burst pipe, they may be eligible for coverage under their policy. However, if the damage results from a slow leak that developed over time, it may not be covered without additional provisions. Understanding these distinctions can help homeowners make informed decisions when filing water damage insurance claims and prevent potential coverage disputes.

Importance of Thorough Documentation for Insurance Claims

Thorough documentation is essential when filing insurance claims for water damage, as it serves as critical evidence to support the extent of the damage incurred. For example, detailed photographs and videos of the water-damaged areas provide visual proof of the harm caused, aiding insurance adjusters in assessing the claim accurately. Additionally, keeping a written log of all communication with insurance companies and receipts for repairs can streamline the claims process and expedite settlements.

In Louisiana, insurance companies typically require specific documentation, such as timestamps on photos and detailed descriptions of the damage, to support water damage claims. Homeowners should document the progression of water damage from its initial occurrence to the extent of the impact on the property. By providing thorough documentation, homeowners can strengthen their claims and ensure that insurance adjusters have all the necessary information to process the claim efficiently.

The role of documentation in ensuring a fair and timely settlement for water damage insurance claims cannot be overstated. By meticulously recording the damage, repairs, and communication with insurance companies, homeowners create a comprehensive record that supports their claim. This level of documentation not only expedites the claims process but also minimizes the risk of disputes or delays in receiving compensation. Effective documentation is a key factor in successfully navigating water damage insurance claims in Louisiana and maximizing the likelihood of a favorable outcome.

Effective Strategies for Interacting with Insurance Adjusters

Interacting with insurance adjusters during water damage claims requires homeowners to be well-prepared and informed about common tactics used by adjusters. For example, adjusters may attempt to downplay the extent of the damage or offer quick settlements that undervalue the actual costs of repairs. By understanding these tactics, homeowners can advocate for themselves effectively and negotiate fair settlements with insurance companies.

Preparing for meetings with insurance adjusters involves maintaining detailed records of all communication and documenting the damages thoroughly with photos and descriptions. Homeowners should also familiarize themselves with the details of their insurance policy to ensure they understand their coverage and entitlements. By staying organized and proactive in their interactions with adjusters, homeowners can present a strong case for the compensation they deserve and increase their chances of a successful claim outcome.

Maintaining a detailed log of all communication with insurance adjusters is crucial for tracking the progress of the claim and ensuring that all relevant information is documented. By recording the dates, details, and outcomes of conversations with adjusters, homeowners create a comprehensive record that can be referenced throughout the claims process. This level of organization and communication helps homeowners stay informed, assert their rights, and effectively navigate the complexities of dealing with insurance adjusters during water damage claims.

Drymax's Comprehensive Services for Water Damage Restoration

Drymax offers a comprehensive range of services beyond water damage restoration, including contents cleaning and CIRS mold testing & remediation. For example, in addition to restoring water-damaged properties, Drymax assists homeowners in salvaging and cleaning their personal belongings affected by water damage incidents. This holistic approach to restoration ensures that homeowners can recover not only their property but also their cherished possessions with the help of a single service provider.

Drymax's certifications and accreditations in the water damage restoration industry underscore the company's commitment to maintaining high standards of service. By holding industry-specific certifications and staying abreast of best practices, Drymax ensures that homeowners receive top-quality restoration services that adhere to industry guidelines. This dedication to excellence and professionalism sets Drymax apart as a trusted and reliable partner for homeowners in need of water damage restoration in Louisiana.

Additionally, Drymax's commitment to utilizing advanced technology and techniques in water damage restoration showcases the company's dedication to delivering efficient and effective services. By leveraging cutting-edge tools and methods, Drymax can expedite the restoration process and ensure thorough remediation of water damage. Homeowners benefit from the expertise and innovation of Drymax, knowing that their properties are in capable hands for restoration.

Step-By-Step Guide for Filing Water Damage Insurance Claims

When filing water damage insurance claims in Louisiana, homeowners should follow a systematic approach to ensure a successful process. For example, promptly contacting the insurance agent after discovering water damage is crucial to initiating the claims process and understanding the next steps. By seeking guidance from the agent on policy requirements and deadlines, homeowners can ensure that they meet all necessary criteria for filing a claim and receive timely assistance.

Thoroughly documenting the water damage with detailed photographs, videos, and written descriptions is essential for supporting the insurance claim. Homeowners should capture the extent of the damage from multiple angles and provide context to the images through descriptive accounts. This documentation serves as crucial evidence for insurance adjusters to assess the claim accurately and make informed decisions regarding compensation.

Completing the claim form accurately and submitting it along with the supporting documentation promptly is a critical step in the claims process. By providing all relevant details about the water damage and adhering to submission deadlines, homeowners can expedite the review process and increase the likelihood of a favorable settlement. Staying in regular contact with the insurance adjuster and providing any additional information they may request are also essential for a smooth claims process. By following these steps diligently and maintaining open communication with insurance representatives, homeowners can navigate water damage insurance claims effectively and secure the best possible outcome.

Coverage Options and Limitations in Water Damage Insurance Policies

Understanding the coverage options and limitations in water damage insurance policies is essential for homeowners in Louisiana to ensure adequate protection for their properties. For instance, standard homeowners' insurance policies typically cover sudden and accidental water damage, such as burst pipes or appliance leaks. However, gradual damage from long-term plumbing issues may not be covered without specific endorsements. By reviewing their policies carefully, homeowners can identify potential coverage gaps and make informed decisions about additional protections.

In Louisiana, flood damage is a common exclusion from standard homeowners' insurance policies, requiring homeowners to purchase separate flood insurance for comprehensive coverage. Given the state's susceptibility to flooding, particularly during hurricane season, having flood insurance can be crucial for safeguarding properties against water damage. Additionally, understanding coverage options such as additional living expenses (ALE) can help homeowners plan for temporary housing and essential expenses if their homes become uninhabitable due to water damage. By exploring these coverage options, homeowners can tailor their insurance policies to meet their specific needs and mitigate financial risks associated with water damage incidents.

The process for appealing coverage decisions made by insurance companies is an important aspect for homeowners to be aware of. In cases where coverage disputes arise or claims are denied, homeowners have the right to appeal these decisions and seek a fair resolution. Understanding the appeals process and seeking legal advice when necessary can help homeowners protect their interests and ensure that they receive the compensation they are entitled to under their insurance policies. By being proactive and informed about coverage options and limitations, homeowners can navigate water damage insurance claims with confidence and secure appropriate protection for their properties.

Accessing Legal Support and Resources for Water Damage Claims

Accessing legal support and resources can be beneficial for homeowners dealing with complex water damage insurance claims in Louisiana. Legal assistance can provide valuable guidance on interpreting insurance policies, resolving coverage disputes, and navigating the claims process effectively. By seeking legal advice when needed, homeowners can protect their rights and interests throughout the claims process and ensure a fair resolution to their water damage claims.

Public adjusters play a vital role in assisting homeowners with water damage insurance claims by providing expertise in assessing damage, interpreting policies, and negotiating with insurance adjusters. These professionals work on behalf of the insured to ensure fair settlements and streamline the claims process. By leveraging the services of public adjusters, homeowners can navigate the intricacies of insurance claims more effectively and increase their chances of receiving appropriate compensation for water damage incidents.

Understanding the resources available for legal assistance, FEMA claims, SBA disaster loans, and insurance disputes is essential for homeowners in Louisiana. By being informed about the options for legal support and financial assistance, homeowners can take proactive steps to protect their properties and interests in the event of water damage. Seeking guidance from legal professionals and utilizing available resources can empower homeowners to navigate the complexities of water damage insurance claims with confidence and secure the best possible outcomes for their claims.

Comparative Analysis: Drymax vs. Top Competitors

Comparing Drymax to its competitors in the water damage restoration industry in Louisiana reveals key factors that set Drymax Mold apart as a leading service provider. For example, Drymax's extensive service offerings, including water damage restoration, fire damage restoration, mold removal, and CIRS mold testing & remediation, provide homeowners with a comprehensive solution for property restoration. In contrast, some competitors may offer a narrower range of services, limiting homeowners' options for addressing water damage incidents effectively.

Drymax's certifications and accreditations in the water damage restoration industry demonstrate the company's commitment to upholding industry standards and delivering top-quality services. By holding recognized certifications and staying updated on best practices, Drymax ensures that homeowners receive professional and reliable restoration solutions that meet industry requirements. This dedication to excellence and professionalism distinguishes Drymax as a trusted and reputable choice for water damage restoration in Louisiana.

Customer testimonials highlighting positive experiences with Drymax's services serve as endorsements of the company's expertise, professionalism, and exceptional work quality. These testimonials not only reflect satisfied clients' experiences but also illustrate Drymax's consistent delivery of reliable and effective restoration services. In contrast, while competitors may offer similar services, the endorsement from satisfied customers positions Drymax as a preferred provider for homeowners seeking trustworthy and top-rated restoration services in Louisiana.

For homeowners seeking reliable and expert assistance with water damage restoration, Drymax stands out as a reputable and experienced choice in the industry. By leveraging Drymax's comprehensive services, certifications, and positive customer testimonials, homeowners can trust in the company's expertise and commitment to delivering high-quality restoration solutions.

Navigating water damage insurance claims in Louisiana requires homeowners to be proactive, well-prepared, and informed about their policy coverage and the claims process. By taking immediate action when faced with water damage, documenting the damage thoroughly, and interacting effectively with insurance adjusters, homeowners can increase their chances of a successful claim outcome. Partnering with a reputable restoration company like Drymax can further streamline the claims process and ensure thorough restoration of properties affected by water damage.

Final thoughts: homeowners in Louisiana facing water damage incidents can benefit from following a step-by-step guide for filing insurance claims and understanding the coverage options available to them. By being informed, proactive, and diligent in their approach to handling water damage claims, homeowners can protect their properties and secure the necessary compensation for restoration.

For expert assistance with water damage restoration and to explore available resources, homeowners are encouraged to reach out to professionals in the field or visit Drymax's website at DryMax for comprehensive information on their services.